Empowering Financial Literacy in Nigeria through Digital Innovation

Introduction

Introduction

Challenge

Challenge

To create a concept for a financial app, that not only facilitates transactions but also empowers Nigerians with financial literacy. The goal is to bridge the gap in understanding modern financial tools, promoting savings and investments, and ensuring secure navigation of digital transactions.

To create a concept for a financial app, that not only facilitates transactions but also empowers Nigerians with financial literacy. The goal is to bridge the gap in understanding modern financial tools, promoting savings and investments, and ensuring secure navigation of digital transactions.

Results

Results

A comprehensive financial app that integrates education and transactions. The app focuses on user education through interactive tools, personalized financial advice, and secure transaction features. It emphasizes financial empowerment, helping users make informed decisions, save effectively, and invest wisely. The app’s design prioritizes user experience, ensuring accessibility and ease of use for all Nigerians.

A comprehensive financial app that integrates education and transactions. The app focuses on user education through interactive tools, personalized financial advice, and secure transaction features. It emphasizes financial empowerment, helping users make informed decisions, save effectively, and invest wisely. The app’s design prioritizes user experience, ensuring accessibility and ease of use for all Nigerians.

Duration

Duration

6 weeks (2024)

6 weeks (2024)

My Role

My Role

UX/UI Designer, Researcher, and Brand Strategist

UX/UI Designer, Researcher, and Brand Strategist

Contribution

Contribution

User research, UX/UI design, prototyping, brand identity development, and copywriting.

User research, UX/UI design, prototyping, brand identity development, and copywriting.

Team

Team

Self-managed, responsible for all aspects of design and development.

Self-managed, responsible for all aspects of design and development.

Problem Definition

Problem Definition

How might we empower Nigerian users to improve their financial literacy while addressing the complexities of digital finance management, ensuring personalized guidance, and enhancing security, so that they can achieve long-term financial wellness with confidence?

How might we empower Nigerian users to improve their financial literacy while addressing the complexities of digital finance management, ensuring personalized guidance, and enhancing security, so that they can achieve long-term financial wellness with confidence?

Concept development

Concept development

Many individuals manage digital transactions daily but lack the knowledge to optimize their financial well-being. Econest bridges this gap by offering tools that promote comprehensive financial understanding. Econest starts by understanding users' habits and providing tailored advice, enhancing their financial stability and health.

Many individuals manage digital transactions daily but lack the knowledge to optimize their financial well-being. Econest bridges this gap by offering tools that promote comprehensive financial understanding. Econest starts by understanding users' habits and providing tailored advice, enhancing their financial stability and health.

Brand identity and market positioning

Brand identity and market positioning

Brand purpose

Brand purpose

Master Your Money, Secure Your Future

Master Your Money, Secure Your Future

Vision

Vision

Empower every Nigerian to achieve financial literacy and independence.

Empower every Nigerian to achieve financial literacy and independence.

Mission

Mission

Econest transforms financial management by integrating education into daily financial activities, promoting informed decision-making, and fostering long-term well-being.

Econest transforms financial management by integrating education into daily financial activities, promoting informed decision-making, and fostering long-term well-being.

Core Features

Core Features

Innovative Tools: Personalized guidance and practical resources.

Informed Decisions: Education-led financial planning and advice.

Accessible to All: Making financial security and knowledge available to every Nigerian.

Innovative Tools: Personalized guidance and practical resources.

Informed Decisions: Education-led financial planning and advice.

Accessible to All: Making financial security and knowledge available to every Nigerian.

Competitive landscape

Competitive landscape

By analyzing a variety of financial management apps, several aspects stood out: many apps focus heavily on either budgeting or investing but lack comprehensive financial literacy education. Apps like Mint and YNAB excel in budgeting, while Robinhood focuses on investments. However, few integrate personalized financial advice and interactive elements to keep users engaged and motivated.

By analyzing a variety of financial management apps, several aspects stood out: many apps focus heavily on either budgeting or investing but lack comprehensive financial literacy education. Apps like Mint and YNAB excel in budgeting, while Robinhood focuses on investments. However, few integrate personalized financial advice and interactive elements to keep users engaged and motivated.

Mint & YNAB

Mint & YNAB

Primarily focus on budgeting for adults, offering detailed transaction tracking and budgeting tools.

Primarily focus on budgeting for adults, offering detailed transaction tracking and budgeting tools.

Robinhood & Revolut

Robinhood & Revolut

Emphasize investments and digital transactions, appealing to younger, tech-savvy users.

Emphasize investments and digital transactions, appealing to younger, tech-savvy users.

Econest

Econest

Bridges the gap by combining financial literacy with savings tools, digital transactions, and personalized advice, providing a holistic approach to financial management for a broad audience.

Bridges the gap by combining financial literacy with savings tools, digital transactions, and personalized advice, providing a holistic approach to financial management for a broad audience.

AaBbCcDd123

AaBbCcDd123

AaBbCcDd123

AaBbCcDd123

AaBbCcDd123

AaBbCcDd123

AaBbCcDd123

AaBbCcDd123

Gilroy Bold

Gilroy Bold

Gilroy Semi Bold

Gilroy Semi Bold

Gilroy Medium

Gilroy Medium

Gilroy Regular

Gilroy Regular

We want to empower your financial journey.

We want to empower your financial journey.

Econest bridges Nigeria's fintech literacy gap. Beyond transactions, Econest offers educational tools for better financial management. Features include monthly savings plans, personalized advice cards, and a rainy day fund, emphasizing overall financial health. Interactive guides promote informed decision-making, transforming how Nigerians engage with their finances for long-term success.

Econest bridges Nigeria's fintech literacy gap. Beyond transactions, Econest offers educational tools for better financial management. Features include monthly savings plans, personalized advice cards, and a rainy day fund, emphasizing overall financial health. Interactive guides promote informed decision-making, transforming how Nigerians engage with their finances for long-term success.

#EconestNigeria

#EconestNigeria

Research & Analysis

Research & Analysis

Qualitative data

Qualitative data

6 interviews revealed opportunities in financial literacy, personalized guidance, and security features.

6 interviews revealed opportunities in financial literacy, personalized guidance, and security features.

"I often feel overwhelmed. There are so many features, but not enough guidance on how to use them effectively"

"I often feel overwhelmed. There are so many features, but not enough guidance on how to use them effectively"

Participants noted that the app offers numerous features, but without clear instructions or guidance, users struggle to make the most out of them, leading to frustration and inefficiency.

Participants noted that the app offers numerous features, but without clear instructions or guidance, users struggle to make the most out of them, leading to frustration and inefficiency.

"I want to understand local investment opportunities and how they fit with my financial goals"

"I want to understand local investment opportunities and how they fit with my financial goals"

Users expressed a desire for more localized financial advice. They want tailored recommendations that align with their specific financial goals and regional investment opportunities, emphasizing the need for personalized content.

Users expressed a desire for more localized financial advice. They want tailored recommendations that align with their specific financial goals and regional investment opportunities, emphasizing the need for personalized content.

"It's my top concern. I've heard stories of scams and I'm always worried about digital theft"

"It's my top concern. I've heard stories of scams and I'm always worried about digital theft"

Security remains a significant worry. Users are apprehensive about the safety of their financial data and the risk of digital fraud. This highlights the importance of robust security features and clear communication about how their data is protected.

Security remains a significant worry. Users are apprehensive about the safety of their financial data and the risk of digital fraud. This highlights the importance of robust security features and clear communication about how their data is protected.

"Managing my finances feels like a chore. I wish the app made it more engaging and less tedious"

"Managing my finances feels like a chore. I wish the app made it more engaging and less tedious"

Participants mentioned that current financial management tools feel laborious and uninspiring. They desire an app that makes managing finances more interactive and enjoyable, reducing the feeling of it being just another task.

Participants mentioned that current financial management tools feel laborious and uninspiring. They desire an app that makes managing finances more interactive and enjoyable, reducing the feeling of it being just another task.

"I'm not sure where to start. The app should have a clear onboarding process"

"I'm not sure where to start. The app should have a clear onboarding process"

Users find it challenging to navigate the app without proper guidance from the beginning. A structured onboarding process is crucial to help them understand the app’s functionalities and how to utilize them effectively from the start.

Users find it challenging to navigate the app without proper guidance from the beginning. A structured onboarding process is crucial to help them understand the app’s functionalities and how to utilize them effectively from the start.

"Tracking my spending habits is difficult. I need clearer insights and visualizations"

"Tracking my spending habits is difficult. I need clearer insights and visualizations"

Participants struggle with understanding their spending patterns due to inadequate tracking tools. They want better insights and visual representations that make it easier to see where their money is going and how they can improve their financial habits.

Participants struggle with understanding their spending patterns due to inadequate tracking tools. They want better insights and visual representations that make it easier to see where their money is going and how they can improve their financial habits.

Overwhelmed by complexity

Overwhelmed by complexity

Users struggled with complex features lacking clear instructions, underutilizing the app.

Users struggled with complex features lacking clear instructions, underutilizing the app.

Desire for localized advice

Desire for localized advice

Participants wanted investment advice aligned with their financial goals and regional opportunities.

Participants wanted investment advice aligned with their financial goals and regional opportunities.

Execution gaps in financial apps

Execution gaps in financial apps

Existing apps have useful tools but fall short in user-friendly guidance, leading to less engagement and trust.

Existing apps have useful tools but fall short in user-friendly guidance, leading to less engagement and trust.

Need for security

Need for security

Security concerns, such as digital fraud, highlighted the need for stronger protection.

Security concerns, such as digital fraud, highlighted the need for stronger protection.

Prioritization of use-cases

Prioritization of use-cases

Econest addresses both Primary and Secondary needs. Primary needs focus on automated goal setting and financial tracking, while secondary needs offer personalized guidance through manual data input. The platform combines Auto-tracking for seamless updates and Manual tracking for tailored financial advice.

Econest addresses both Primary and Secondary needs. Primary needs focus on automated goal setting and financial tracking, while secondary needs offer personalized guidance through manual data input. The platform combines Auto-tracking for seamless updates and Manual tracking for tailored financial advice.

Key features

Key features

Goal setting

Goal setting

Users set financial goals, saving, investing, or budgeting, while Econest provides educational, goal-focused planning.

Users set financial goals, saving, investing, or budgeting, while Econest provides educational, goal-focused planning.

Practical tools

Practical tools

Features like monthly savings plans and a "Rainy Day Fund" to promote good saving habits.

Features like monthly savings plans and a "Rainy Day Fund" to promote good saving habits.

Personalized guidance

Personalized guidance

Interactive tools, personalized tips, and challenges to guide users toward better financial literacy and long-term financial health.

Interactive tools, personalized tips, and challenges to guide users toward better financial literacy and long-term financial health.

Accessible financial management

Accessible financial management

Econest simplifies financial management with intuitive tools that integrate education into everyday financial activities.

Econest simplifies financial management with intuitive tools that integrate education into everyday financial activities.

Wireframe exploration

Wireframe exploration

Translating insights into tangible ideas

Translating insights into tangible ideas

Dive into financial guide

Dive into financial guide

Set up savings plan

Set up savings plan

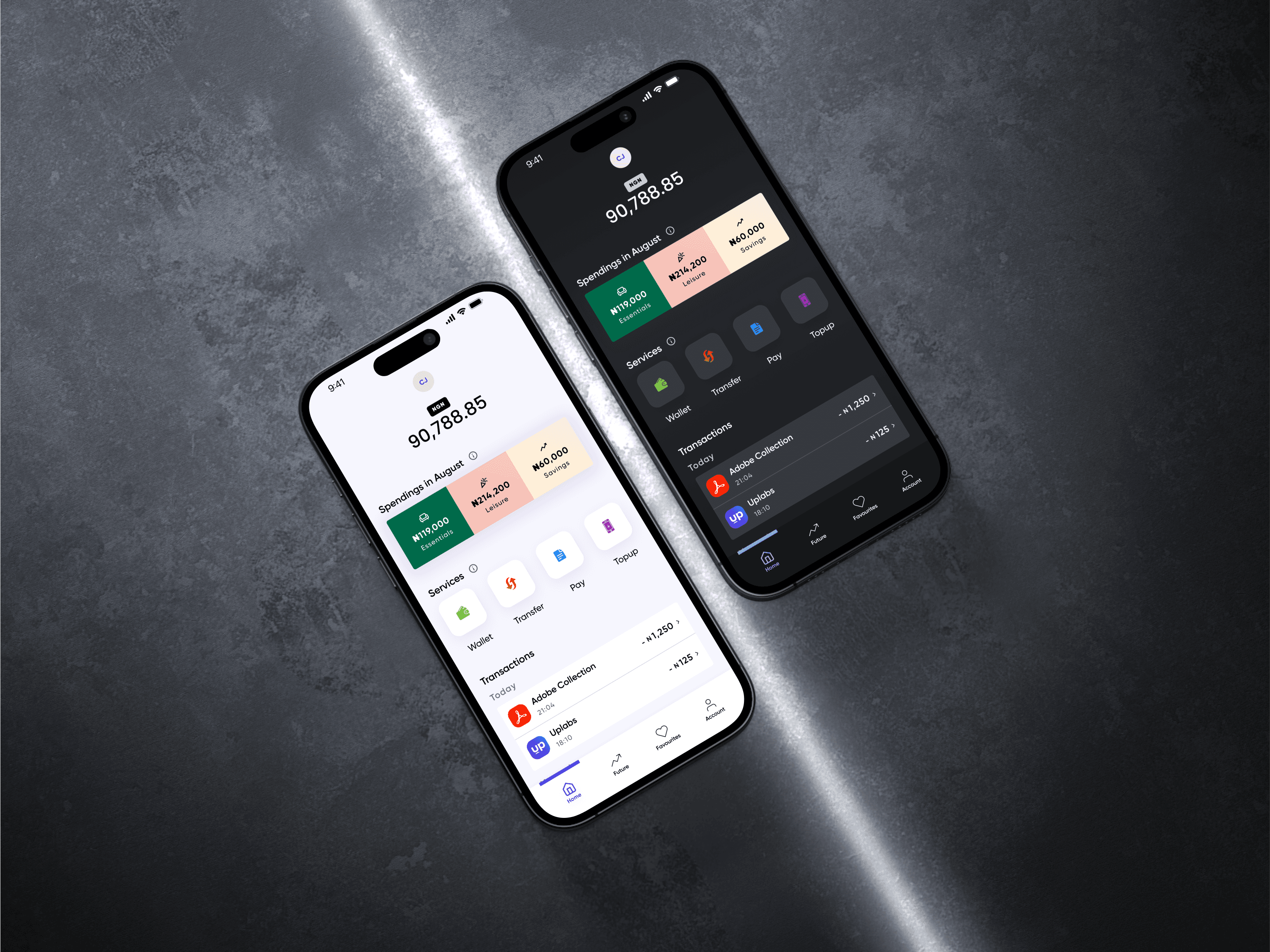

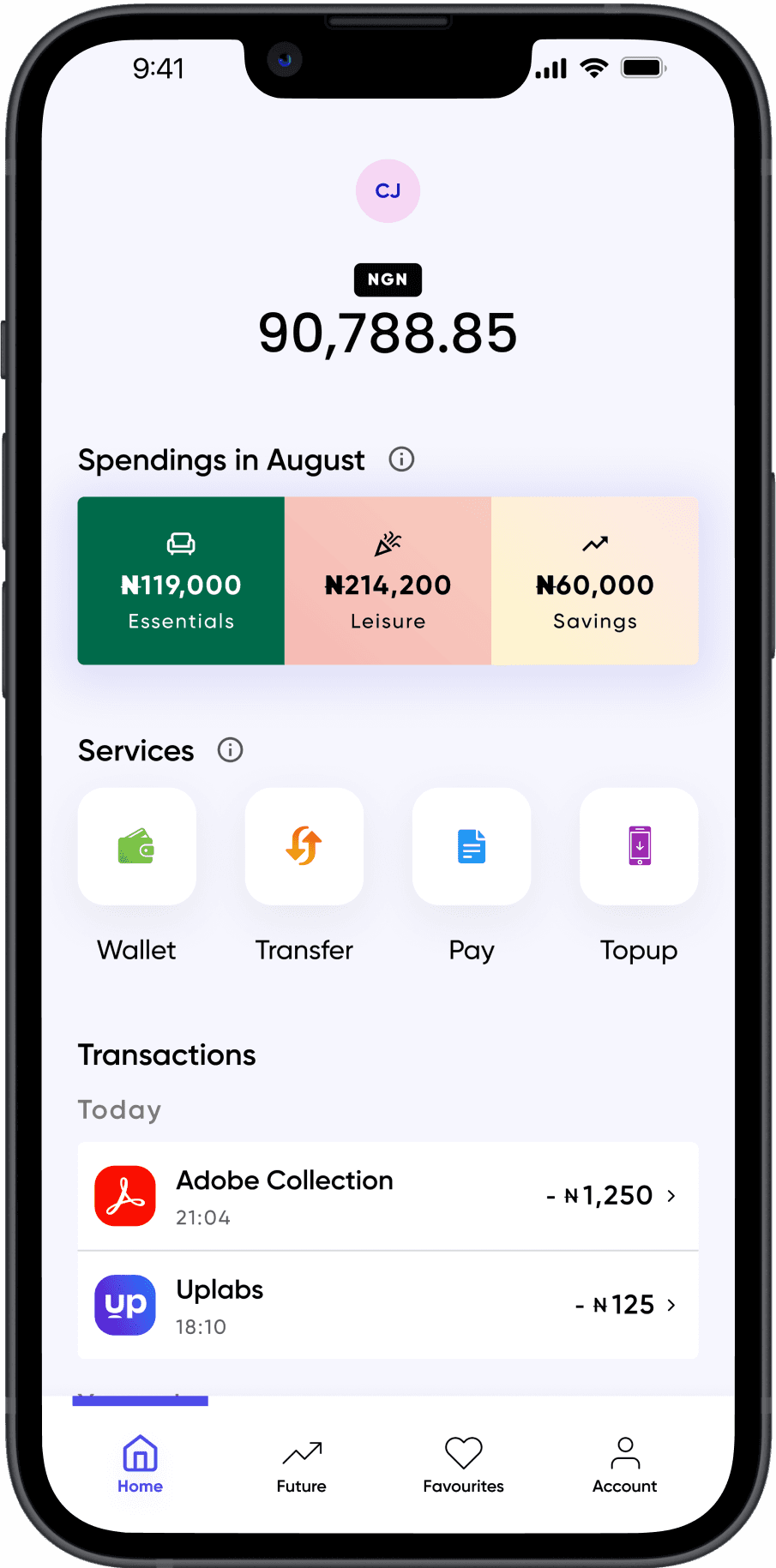

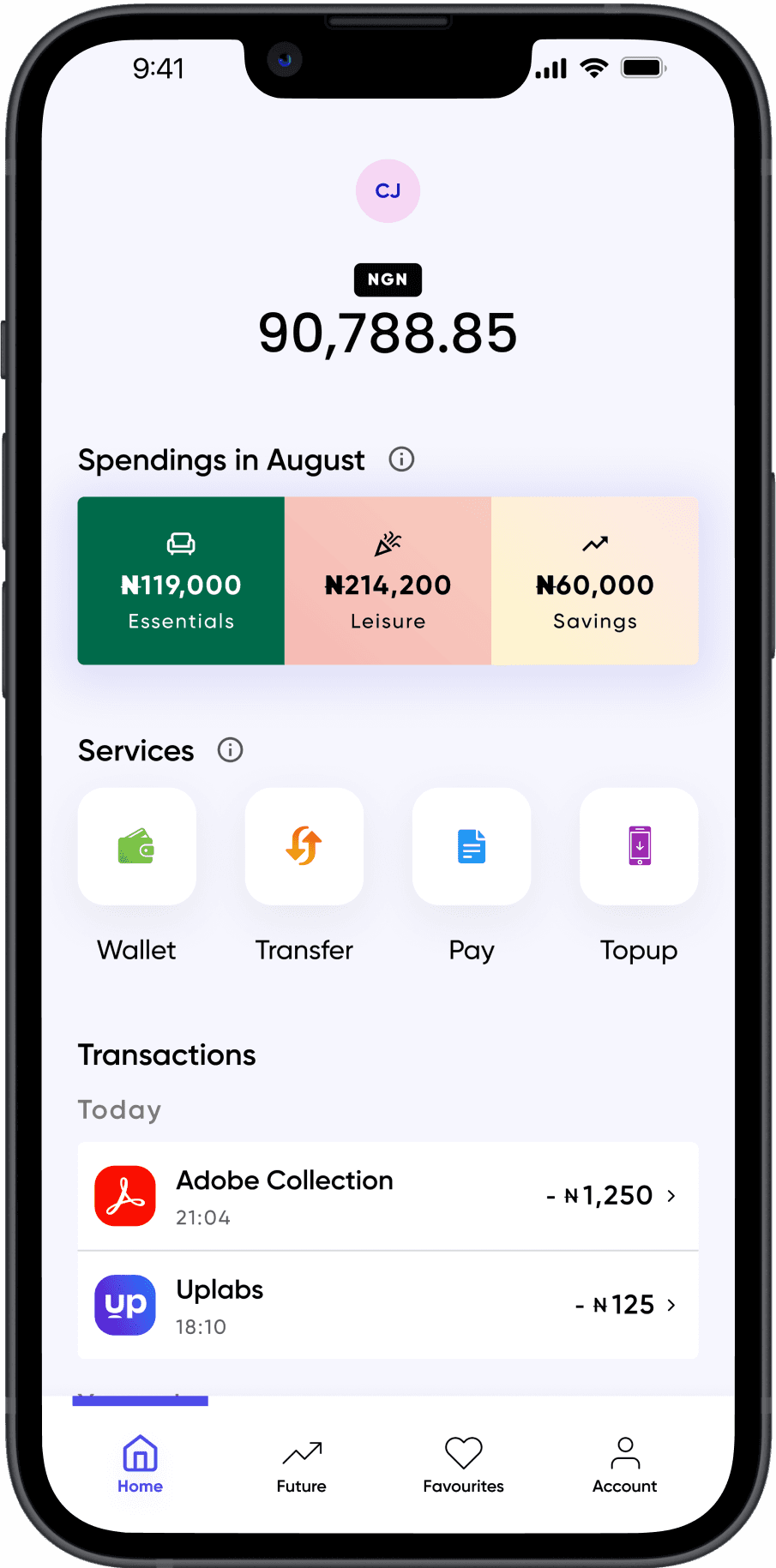

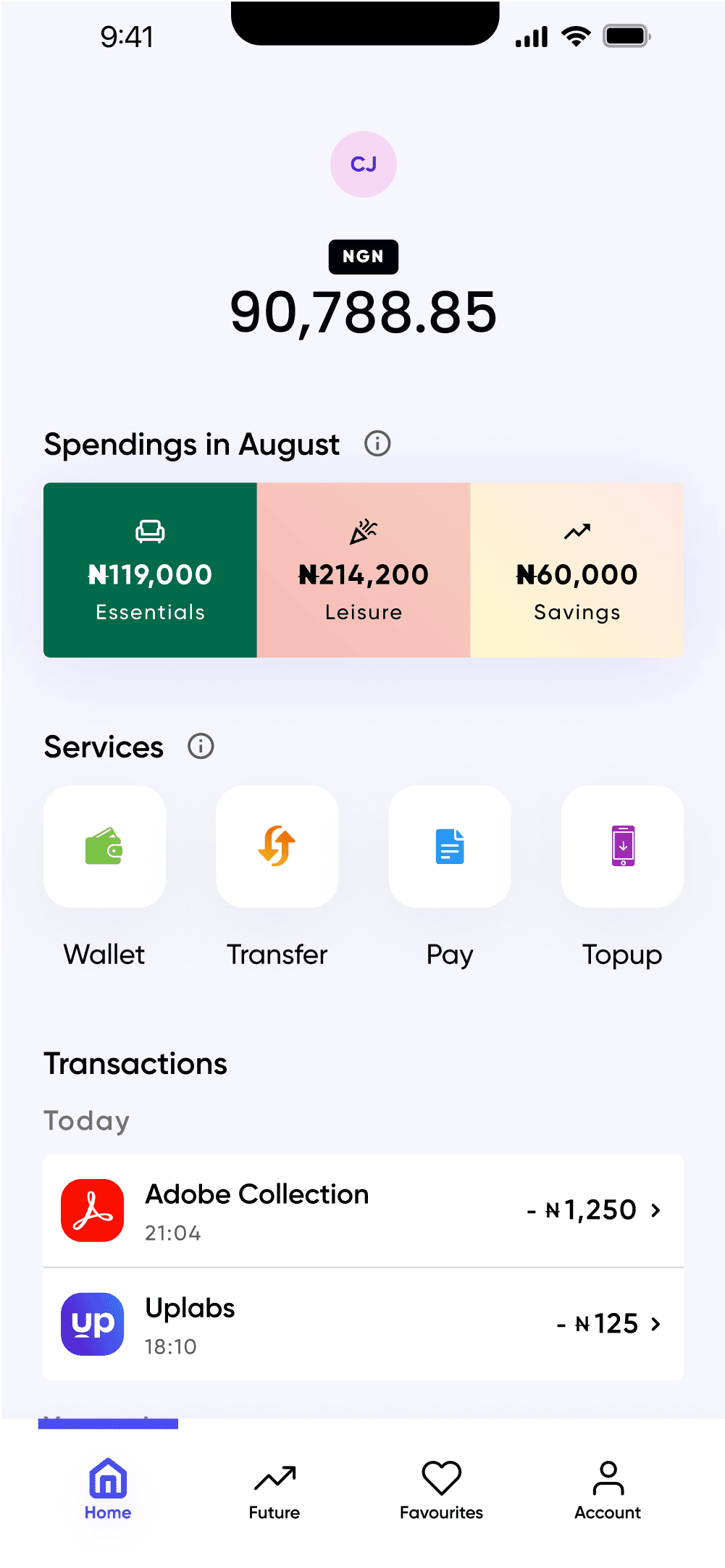

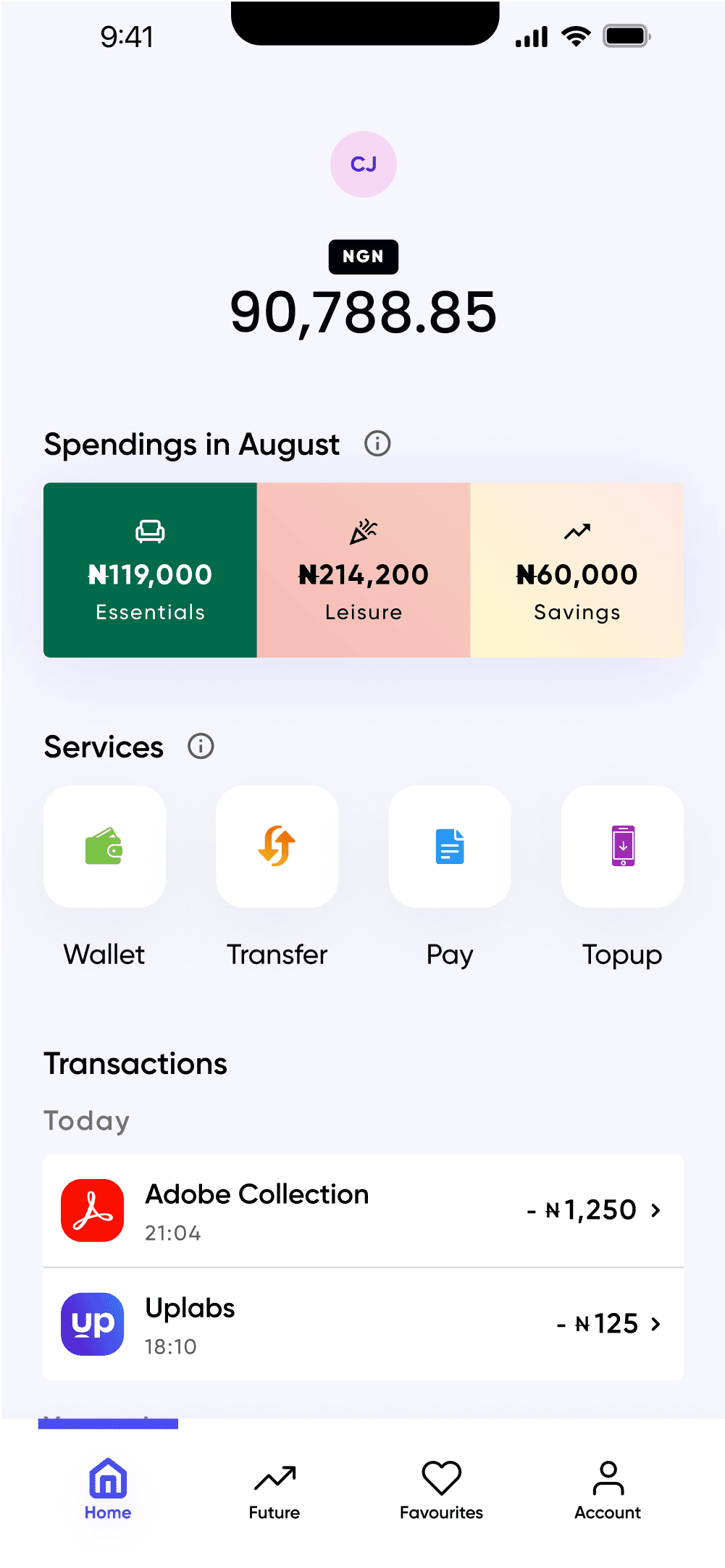

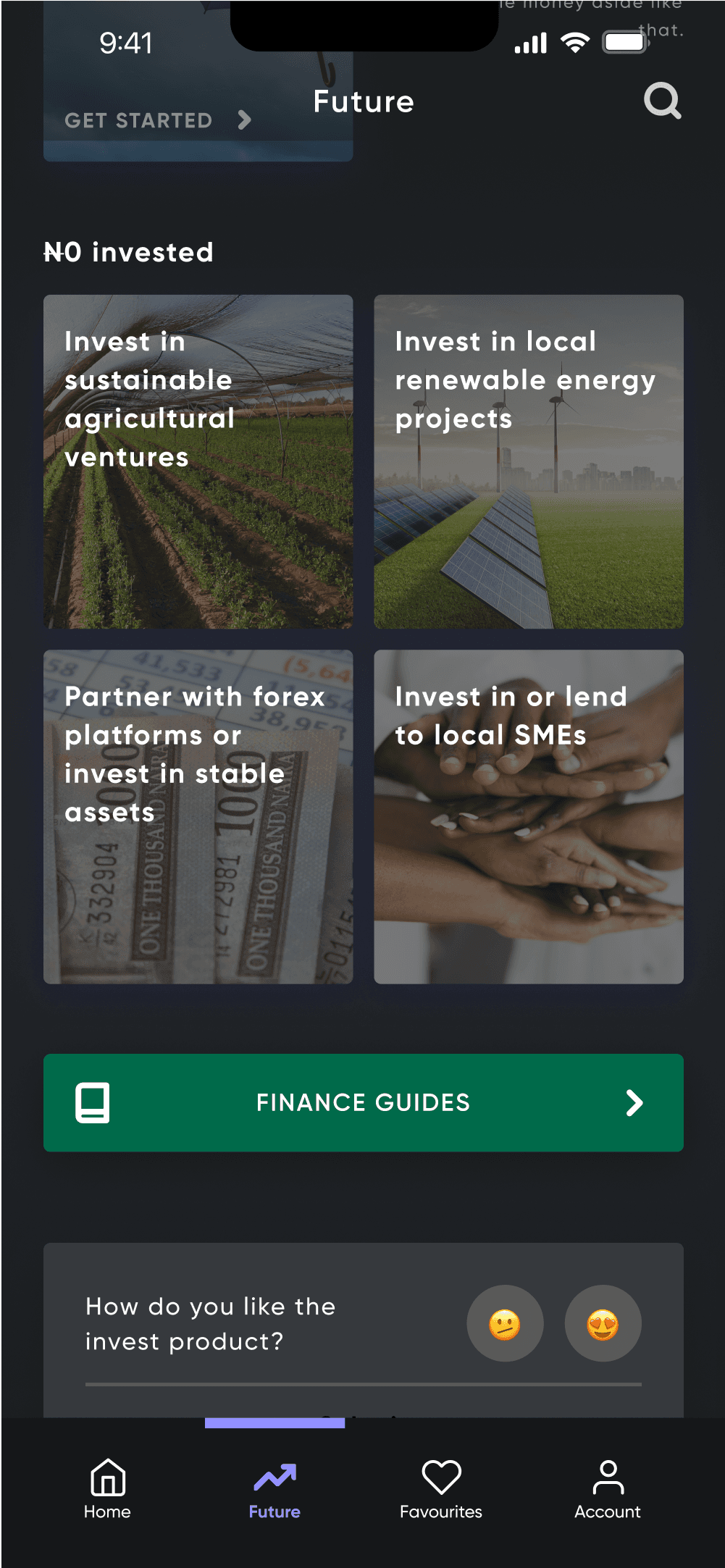

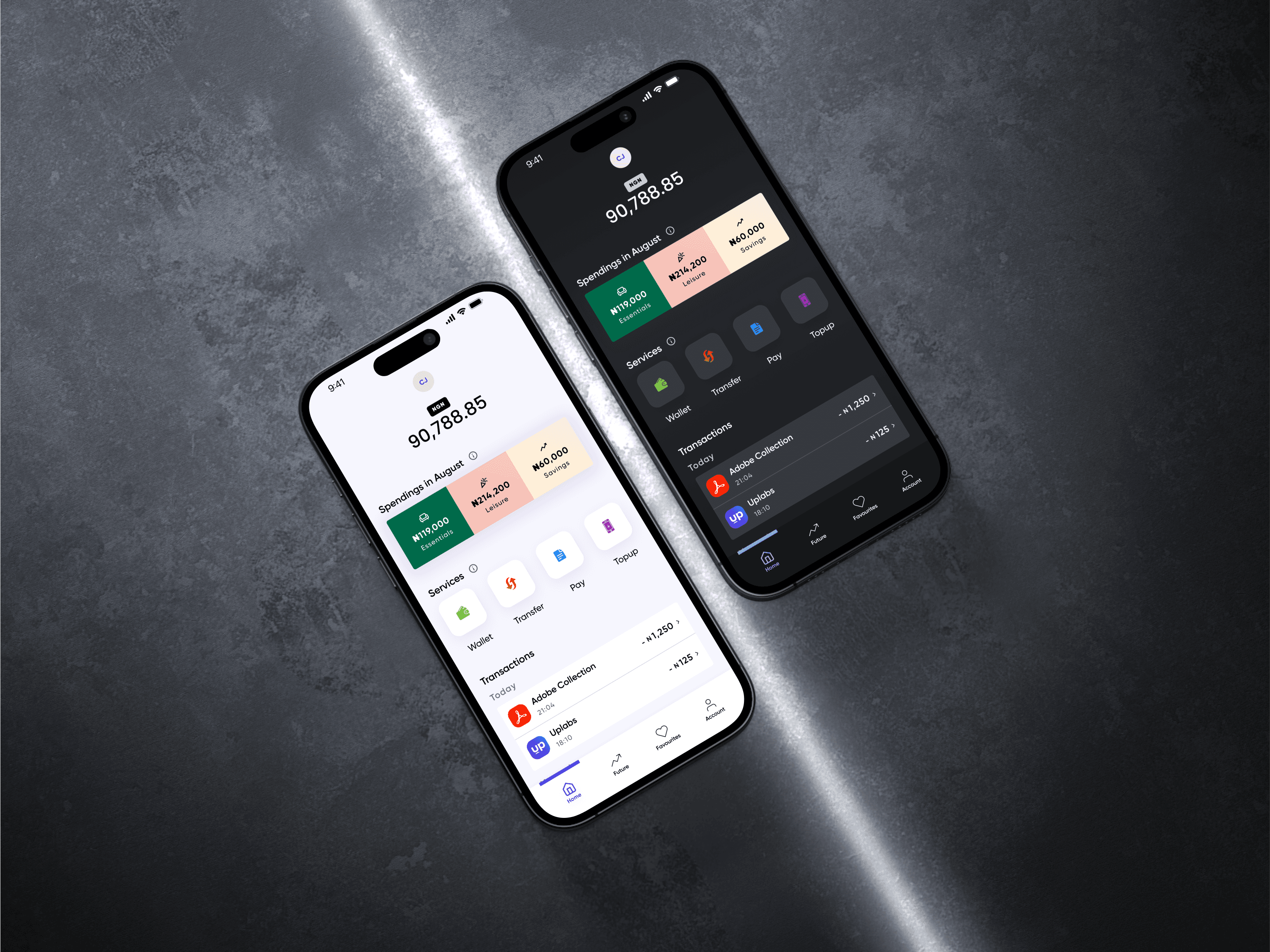

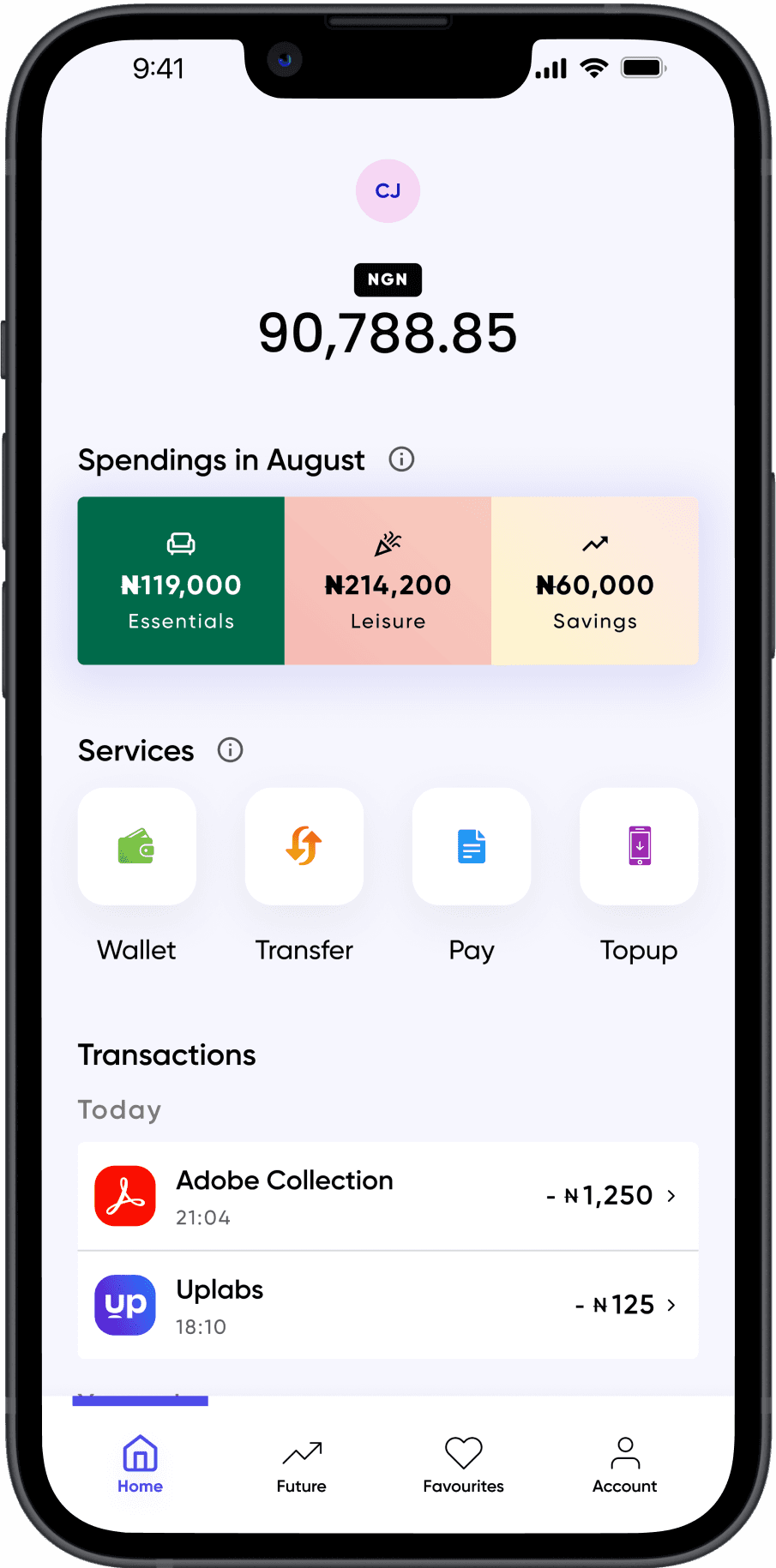

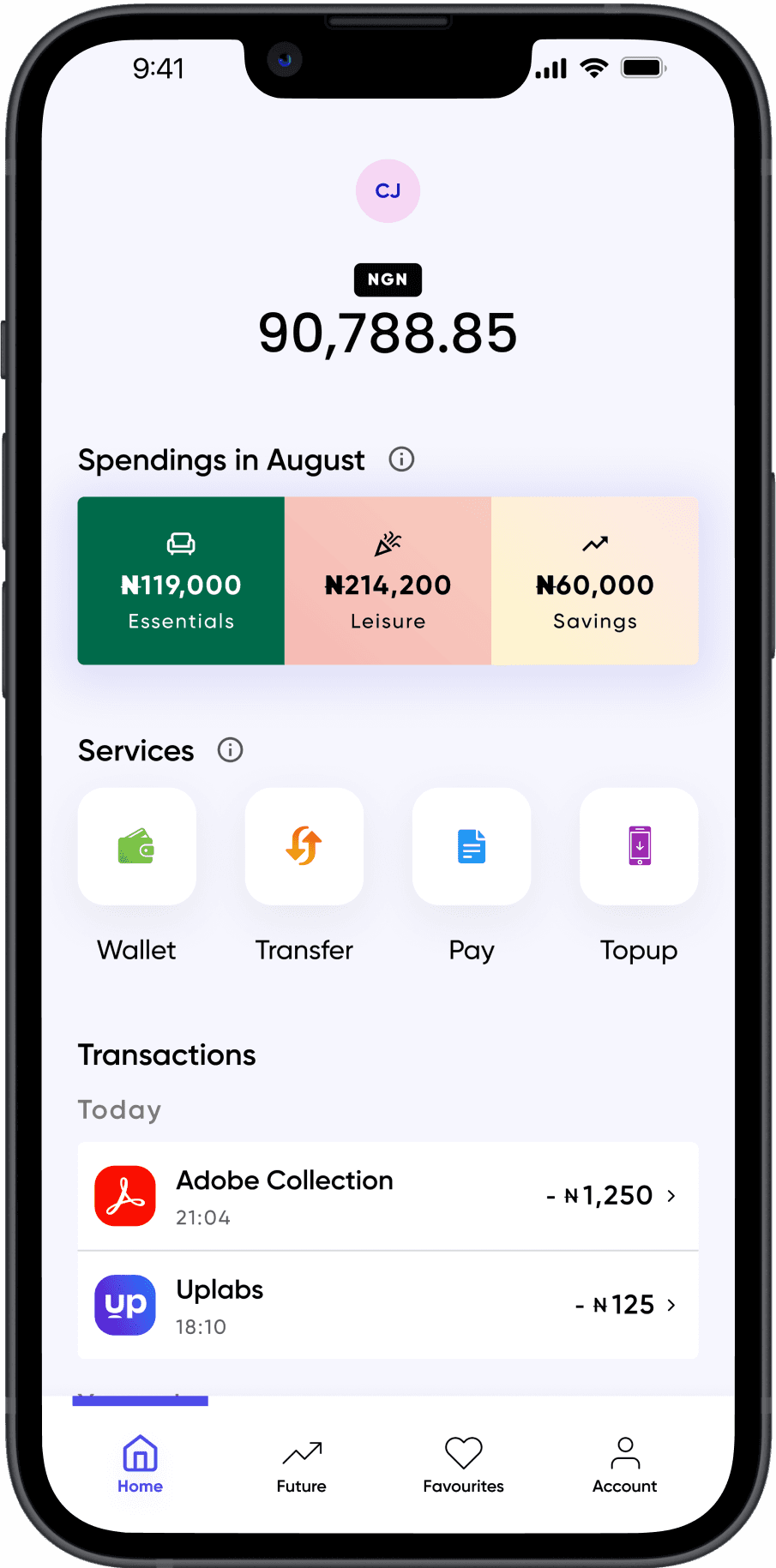

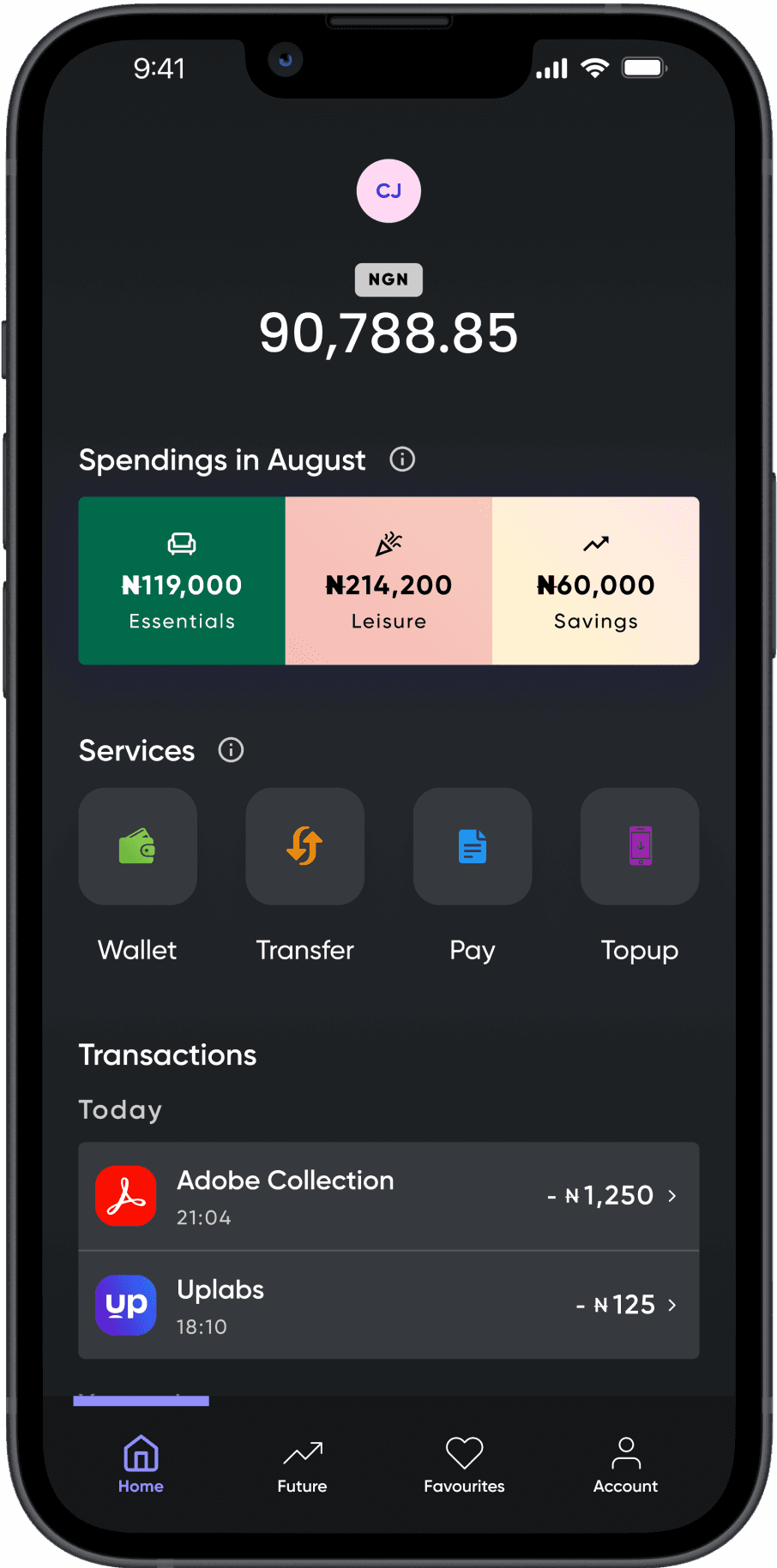

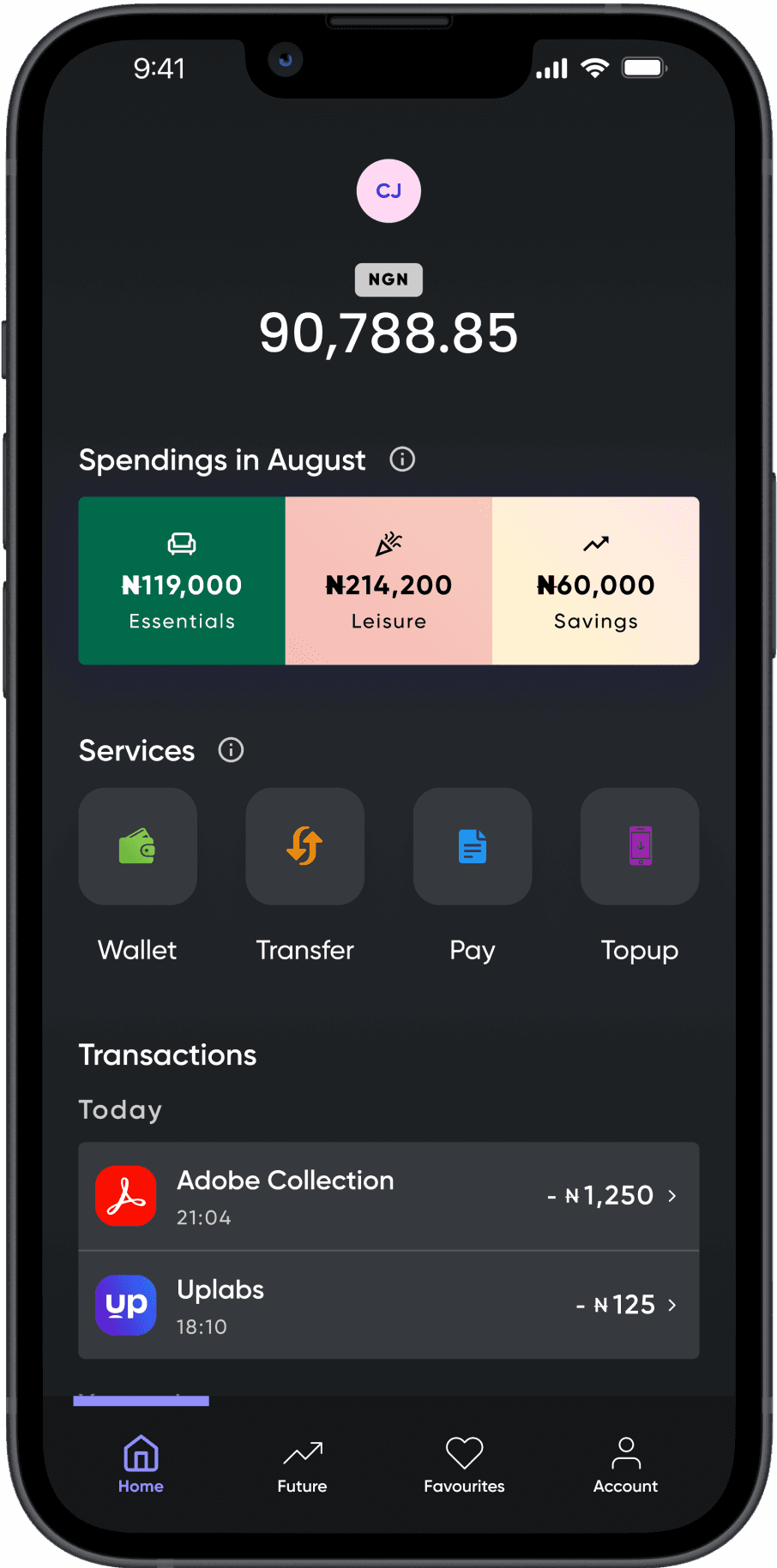

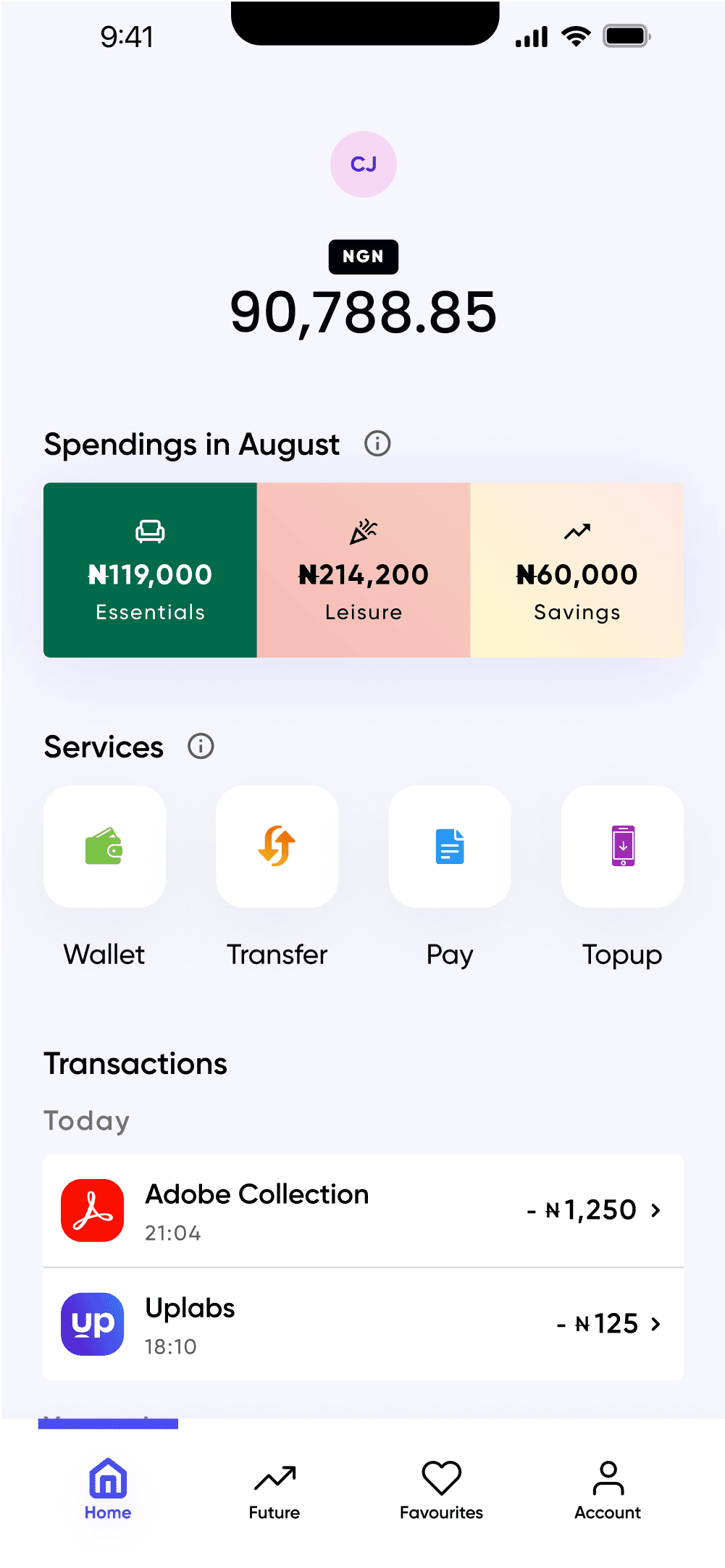

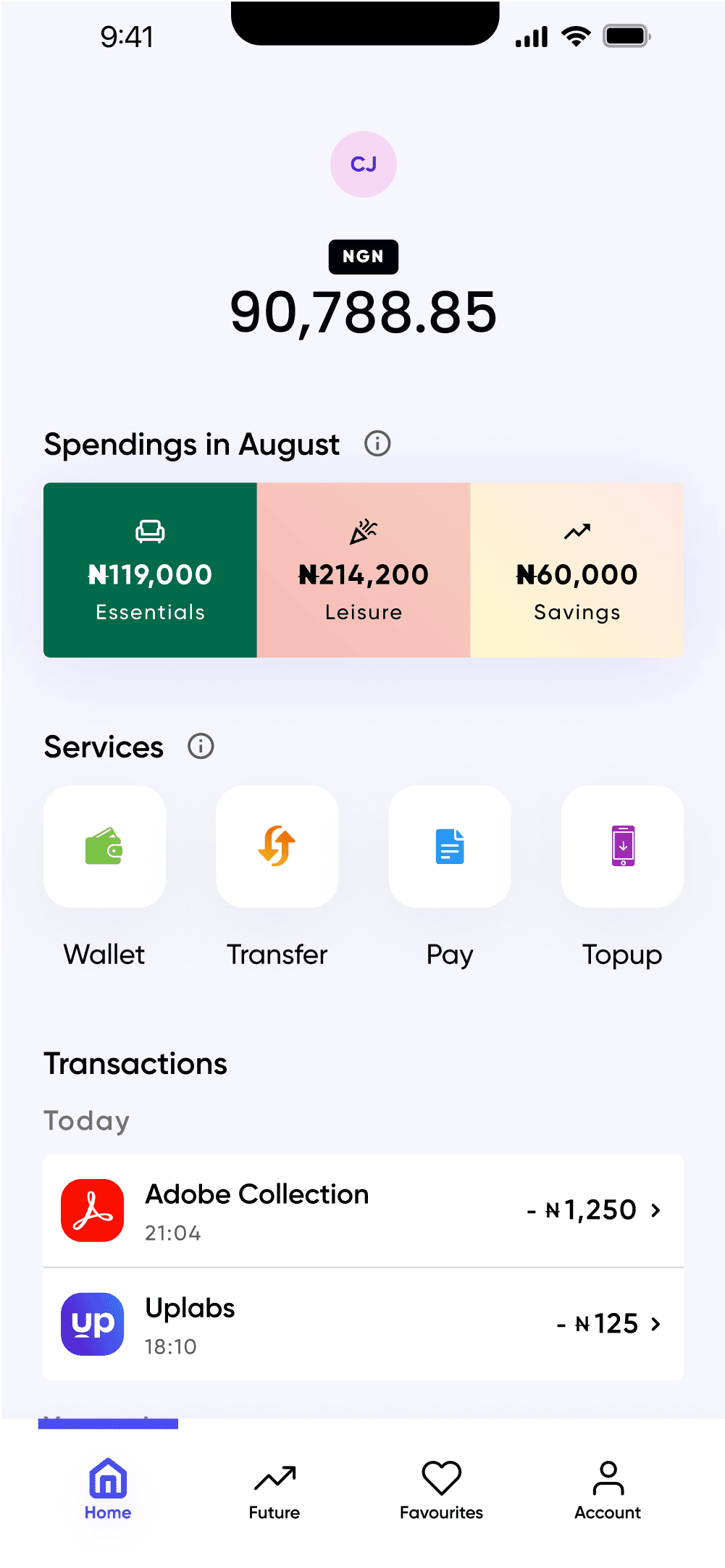

High-fidelity designs

High-fidelity designs

Integrating practical tools like monthly savings plans and a "Rainy Day Fund" to promote regular saving habits. Interactive guides and quizzes to help users understand their financial behavior and improve literacy.

Intentional and specific, Econest matches financial advice to user needs.

The goal is to make financial management intuitive and accessible, integrating education with everyday activities to help users achieve financial health.

Integrating practical tools like monthly savings plans and a "Rainy Day Fund" to promote regular saving habits. Interactive guides and quizzes to help users understand their financial behavior and improve literacy.

Intentional and specific, Econest matches financial advice to user needs.

The goal is to make financial management intuitive and accessible, integrating education with everyday activities to help users achieve financial health.

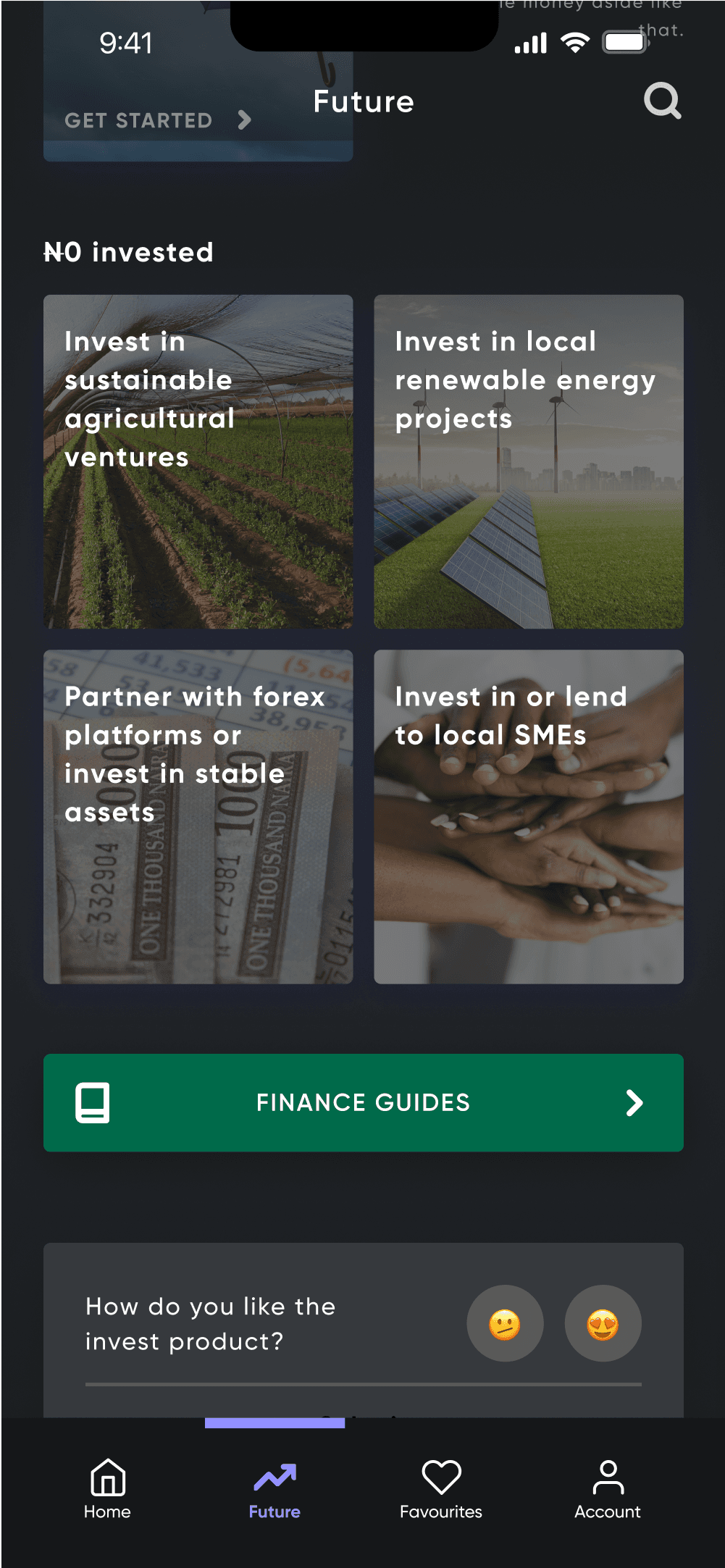

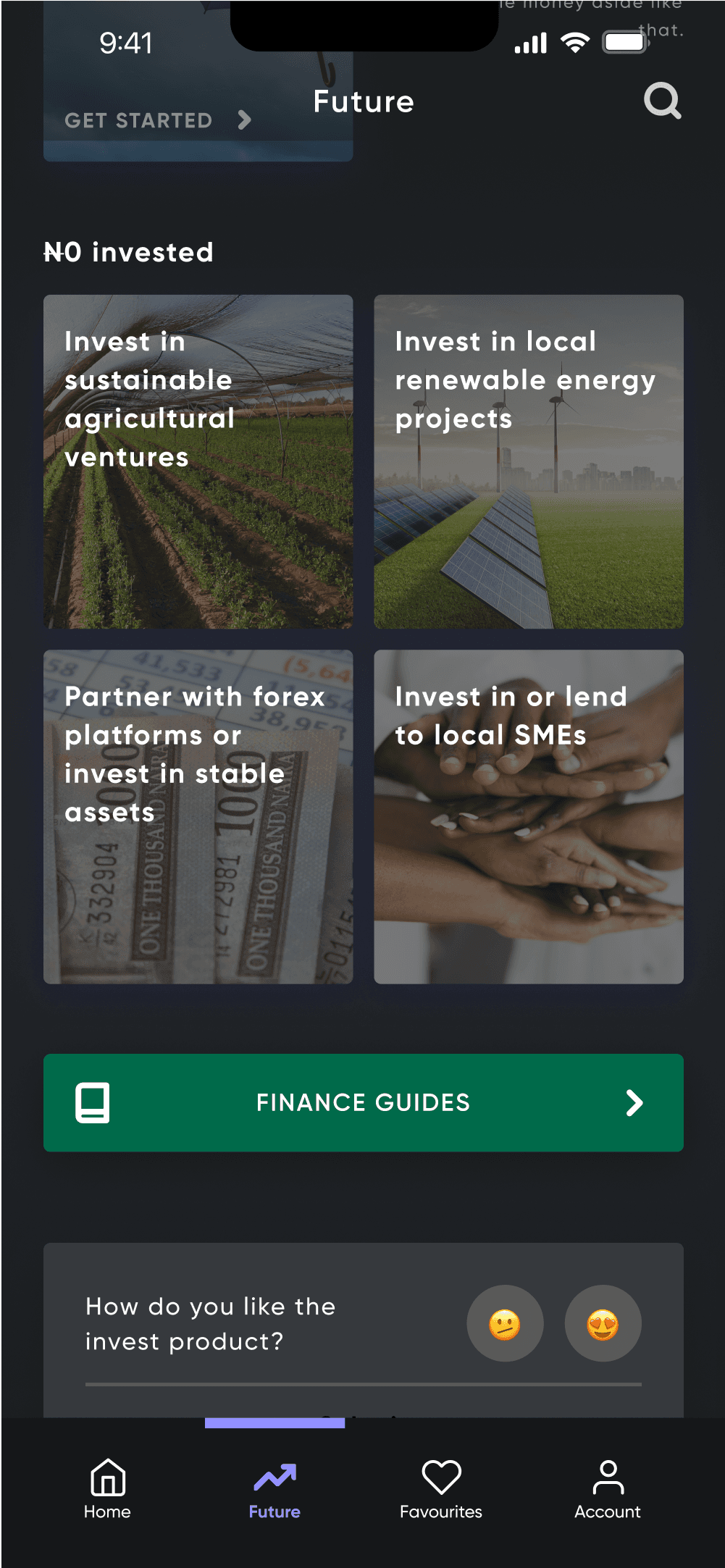

Dive into financial guide

Dive into financial guide

Users can explore curated content, from tutorials to local investment insights.

Users can explore curated content, from tutorials to local investment insights.

Set up savings plan

Set up savings plan

With a few taps, users can define their savings goals, set automated contributions, and watch their financial growth in real-time.

With a few taps, users can define their savings goals, set automated contributions, and watch their financial growth in real-time.

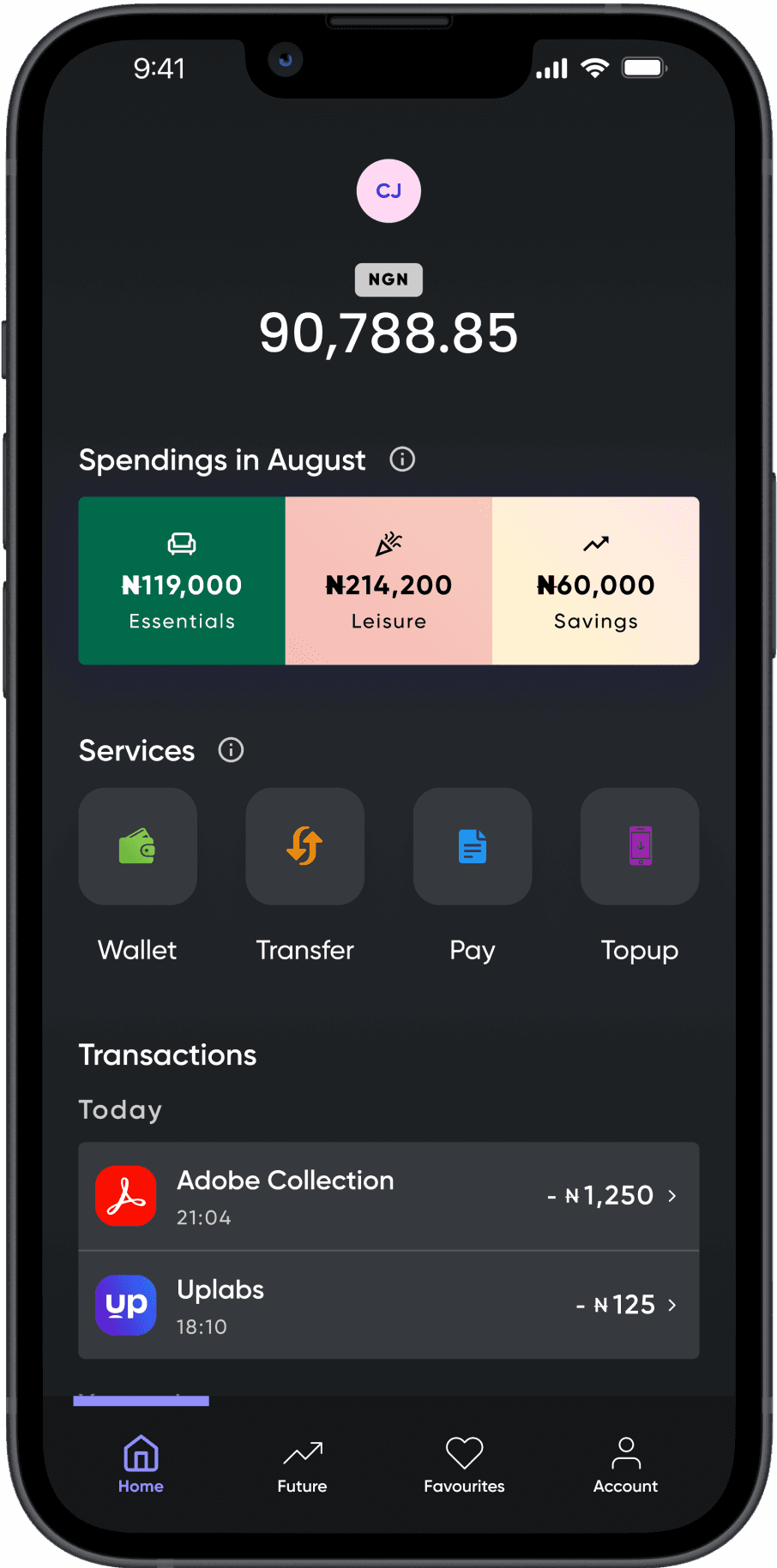

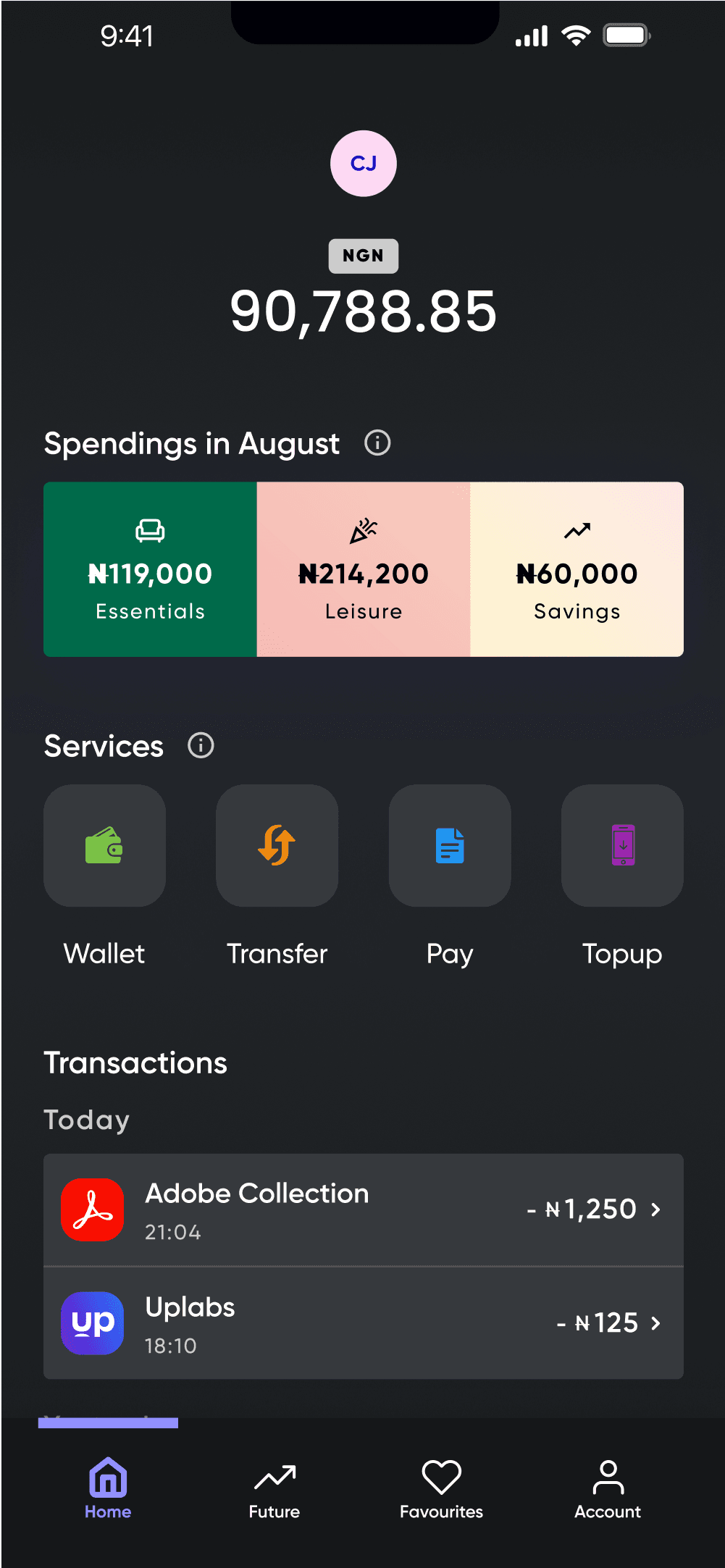

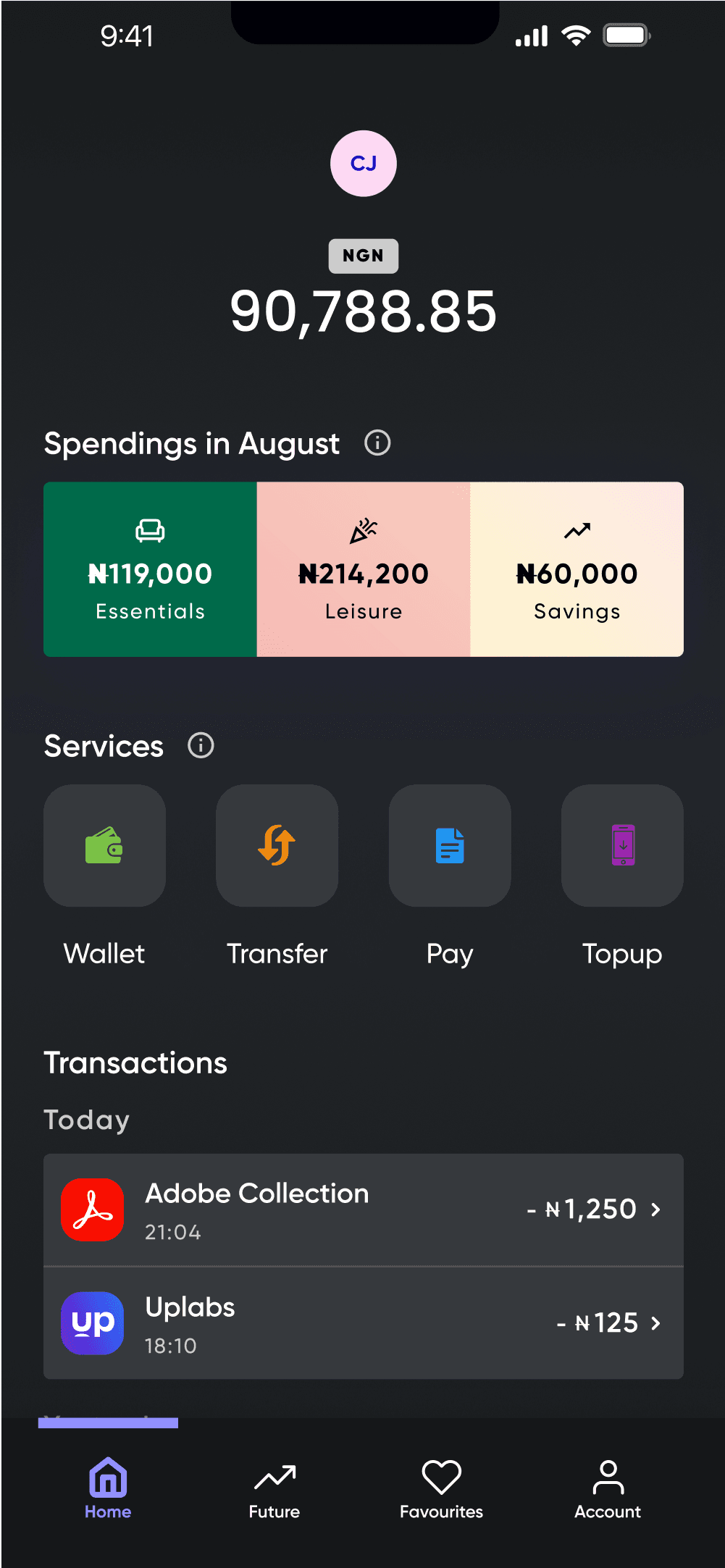

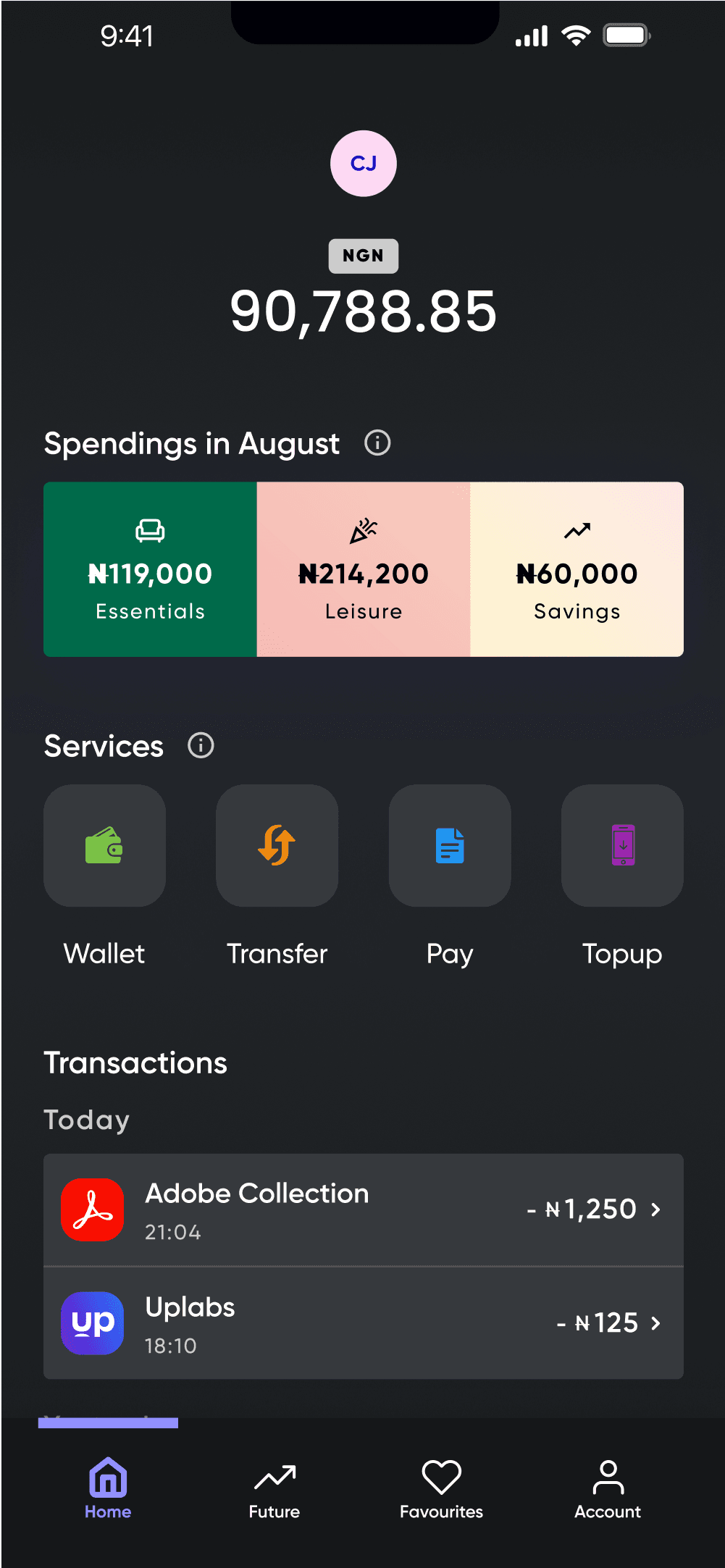

Dark-mode

Dark-mode

Wrap up

Wrap up

As a solo project, I am responsible for all aspects, from ideation to design and future iterations. The app is designed with clear headlines, simple copy, and intuitive icons, ensuring accessibility and usability for a diverse user base.

As a solo project, I am responsible for all aspects, from ideation to design and future iterations. The app is designed with clear headlines, simple copy, and intuitive icons, ensuring accessibility and usability for a diverse user base.

Current state

Current state

The MVP is in its design phase, crafted from research insights to address real financial challenges in Nigeria. While no user testing has been conducted yet, the design is prepared for future validation.

The MVP is in its design phase, crafted from research insights to address real financial challenges in Nigeria. While no user testing has been conducted yet, the design is prepared for future validation.

Lessons learned

Lessons learned

Designing an intuitive app requires balancing simplicity with functionality. Creating relatable, clear copy and intuitive icons were crucial for user comprehension.

Designing an intuitive app requires balancing simplicity with functionality. Creating relatable, clear copy and intuitive icons were crucial for user comprehension.

Future work

Future work

Next steps include validating these design solutions through user testing and iterating based on feedback to improve the product's usability and impact.

Next steps include validating these design solutions through user testing and iterating based on feedback to improve the product's usability and impact.

Challenge

To create a concept for a financial app, that not only facilitates transactions but also empowers Nigerians with financial literacy. The goal is to bridge the gap in understanding modern financial tools, promoting savings and investments, and ensuring secure navigation of digital transactions.

Results

A comprehensive financial app that integrates education and transactions. The app focuses on user education through interactive tools, personalized financial advice, and secure transaction features. It emphasizes financial empowerment, helping users make informed decisions, save effectively, and invest wisely. The app’s design prioritizes user experience, ensuring accessibility and ease of use for all Nigerians.

Duration

1+ month

My Role

UX/UI Designer, Researcher, and Brand Strategist

Contribution

User research, UX/UI design, prototyping, brand identity development, and copywriting.

Team

Self-managed, responsible for all aspects of design and development.

AaBbCcDd123

AaBbCcDd123

AaBbCcDd123

AaBbCcDd123

Gilroy Bold

Gilroy Semi Bold

Gilroy Medium

Gilroy Regular

We want to empower your financial journey.

Econest bridges Nigeria's fintech literacy gap. Beyond transactions, Econest offers educational tools for better financial management. Features include monthly savings plans, personalized advice cards, and a rainy day fund, emphasizing overall financial health. Interactive guides promote informed decision-making, transforming how Nigerians engage with their finances for long-term success.

#EconestNigeria

Introduction

Problem Definition

How might we empower Nigerian users to improve their financial literacy while addressing the complexities of digital finance management, ensuring personalized guidance, and enhancing security, so that they can achieve long-term financial wellness with confidence?

Concept development

Many individuals manage digital transactions daily but lack the knowledge to optimize their financial well-being. Econest bridges this gap by offering tools that promote comprehensive financial understanding. Econest starts by understanding users' habits and providing tailored advice, enhancing their financial stability and health.

Brand identity and market positioning

Brand purpose

Master Your Money, Secure Your Future

Vision

Empower every Nigerian to achieve financial literacy and independence.

Mission

Econest transforms financial management by integrating education into daily financial activities, promoting informed decision-making, and fostering long-term well-being.

Core Features

Innovative Tools: Personalized guidance and practical resources.

Informed Decisions: Education-led financial planning and advice.

Accessible to All: Making financial security and knowledge available to every Nigerian.

Competitive landscape

By analyzing a variety of financial management apps, several aspects stood out: many apps focus heavily on either budgeting or investing but lack comprehensive financial literacy education. Apps like Mint and YNAB excel in budgeting, while Robinhood focuses on investments. However, few integrate personalized financial advice and interactive elements to keep users engaged and motivated.

Mint & YNAB

Primarily focus on budgeting for adults, offering detailed transaction tracking and budgeting tools.

Robinhood & Revolut

Emphasize investments and digital transactions, appealing to younger, tech-savvy users.

Econest

Bridges the gap by combining financial literacy with savings tools, digital transactions, and personalized advice, providing a holistic approach to financial management for a broad audience.

Research & Analysis

Qualitative data

6 interviews revealed opportunities in financial literacy, personalized guidance, and security features.

"I often feel overwhelmed. There are so many features, but not enough guidance on how to use them effectively"

Participants noted that the app offers numerous features, but without clear instructions or guidance, users struggle to make the most out of them, leading to frustration and inefficiency.

"I want to understand local investment opportunities and how they fit with my financial goals"

Users expressed a desire for more localized financial advice. They want tailored recommendations that align with their specific financial goals and regional investment opportunities, emphasizing the need for personalized content.

"It's my top concern. I've heard stories of scams and I'm always worried about digital theft"

Security remains a significant worry. Users are apprehensive about the safety of their financial data and the risk of digital fraud. This highlights the importance of robust security features and clear communication about how their data is protected.

"Managing my finances feels like a chore. I wish the app made it more engaging and less tedious"

Participants mentioned that current financial management tools feel laborious and uninspiring. They desire an app that makes managing finances more interactive and enjoyable, reducing the feeling of it being just another task.

"I'm not sure where to start. The app should have a clear onboarding process"

Users find it challenging to navigate the app without proper guidance from the beginning. A structured onboarding process is crucial to help them understand the app’s functionalities and how to utilize them effectively from the start.

"Tracking my spending habits is difficult. I need clearer insights and visualizations"

Participants struggle with understanding their spending patterns due to inadequate tracking tools. They want better insights and visual representations that make it easier to see where their money is going and how they can improve their financial habits.

Overwhelmed by complexity

Users struggled with complex features lacking clear instructions, underutilizing the app.

Desire for localized advice

Participants wanted investment advice aligned with their financial goals and regional opportunities.

Execution gaps in financial apps

Existing apps have useful tools but fall short in user-friendly guidance, leading to less engagement and trust.

Need for security

Security concerns, such as digital fraud, highlighted the need for stronger protection.

Wireframe exploration

Translating insights into tangible ideas

Dive into financial guide

Set up savings plan

High-fidelity designs

Integrating practical tools like monthly savings plans and a "Rainy Day Fund" to promote regular saving habits. Interactive guides and quizzes to help users understand their financial behavior and improve literacy.

Intentional and specific, Econest matches financial advice to user needs.

The goal is to make financial management intuitive and accessible, integrating education with everyday activities to help users achieve financial health.

Dive into financial guide

Users can explore curated content, from tutorials to local investment insights.

Set up savings plan

With a few taps, users can define their savings goals, set automated contributions, and watch their financial growth in real-time.

Dark-mode

Wrap up

As a solo project, I am responsible for all aspects, from ideation to design and future iterations. The app is designed with clear headlines, simple copy, and intuitive icons, ensuring accessibility and usability for a diverse user base.

Current state

The MVP is in its design phase, crafted from research insights to address real financial challenges in Nigeria. While no user testing has been conducted yet, the design is prepared for future validation.

Lessons learned

Designing an intuitive app requires balancing simplicity with functionality. Creating relatable, clear copy and intuitive icons were crucial for user comprehension.

Future work

Next steps include validating these design solutions through user testing and iterating based on feedback to improve the product's usability and impact.

Prioritization of use-cases

Econest addresses both Primary and Secondary needs. Primary needs focus on automated goal setting and financial tracking, while secondary needs offer personalized guidance through manual data input. The platform combines Auto-tracking for seamless updates and Manual tracking for tailored financial advice.

Key features

Goal setting

Users set financial goals, saving, investing, or budgeting, while Econest provides educational, goal-focused planning.

Practical tools

Features like monthly savings plans and a "Rainy Day Fund" to promote good saving habits.

Personalized guidance

Interactive tools, personalized tips, and challenges to guide users toward better financial literacy and long-term financial health.

Accessible financial management

Econest simplifies financial management with intuitive tools that integrate education into everyday financial activities.

charlesjaja95@gmail.com

charlesjaja95@gmail.com

2024 Charles Jaja

2024 Charles Jaja

Empowering Financial Literacy in Nigeria through Digital Innovation

Empowering Financial Literacy in Nigeria through Digital Innovation